Crypto trading has emerged as a new trend, offering potential for high returns and market volatility. The rise of cryptocurrency trading has captured the attention of investors and traders worldwide.

Table of Contents

The decentralized nature and potential for substantial profits have drawn many to engage in this emerging market. As digital currencies continue to gain traction, the interest in crypto trading has reached new heights. Unlike traditional financial markets, cryptocurrencies operate 24/7, allowing traders to capitalize on market movements at any time.

https://www.youtube.com/watch?v=_Mp7lPQcKr4

This constant activity offers unique opportunities for both experienced and novice traders to participate in the crypto space. However, it is essential for individuals to understand the risks associated with crypto trading and to approach it with a strategic and informed mindset. We will delve into the world of crypto trading, exploring its intricacies and potential for profitability.

1. Understanding Crypto Trading

Credit: ninjapromo.io

2. Fundamental Analysis

3. Technical Analysis

Technical analysis plays a pivotal role in crypto trading, offering valuable insights into price trends and patterns. By analyzing historical market data and chart patterns, traders can make informed decisions and optimize their trading strategies for the dynamic crypto market.

This trend has gained momentum, empowering traders with the tools to navigate the complex world of cryptocurrency trading.

Technical analysis plays a crucial role in crypto trading as it allows traders to make informed decisions based on market data and price chart patterns. By analyzing price movements and indicators, traders can identify potential trends and patterns, leading to more accurate predictions and profitable trades. In this section, we will explore two essential aspects of technical analysis: identifying patterns and trends on price charts and using indicators for better trading decisions.

https://www.youtube.com/watch?v=_Mp7lPQcKr4

Identifying Patterns And Trends On Price Charts

When it comes to analyzing price charts, it is essential to look for patterns and trends that can provide valuable insights into future price movements. Traders use various graphical patterns, such as triangles, head and shoulders, and double tops or bottoms, to recognize potential price reversals or continuations.

Additionally, trend lines can be drawn to determine the overall direction of a cryptocurrency’s price movement. An upward trend line suggests a bullish market, while a downward trend line indicates a bearish market. By identifying these patterns and trends, traders can make more informed decisions and seize profitable trading opportunities.

Using Indicators For Better Trading Decisions

Indicators are mathematical calculations based on historical price data that help traders analyze market trends and predict future price movements. These indicators can be used to confirm or contradict chart patterns and provide additional insights.

https://www.youtube.com/watch?v=_Mp7lPQcKr4

Some popular indicators include the Moving Average (MA), Relative Strength Index (RSI), and Bollinger Bands. The MA smooths out price data, showing the average price over a specific period, and can help identify trends. The RSI measures the strength and speed of price movements, indicating whether a cryptocurrency is overbought or oversold. Bollinger Bands help determine price volatility and potential reversals.

By using these indicators, traders can refine their trading decisions, improve timing, and mitigate risks. However, it is important to remember that no indicator guarantees 100% accuracy, and a holistic approach combining multiple indicators and price analysis is often more effective.

Credit: www.cmcmarkets.com

4. Risk Management

Crypto trading is on the rise, making risk management essential. With the new trend of cryptocurrency, understanding and implementing effective risk management strategies has become crucial for traders.

Risk management is a crucial aspect of successful crypto trading. Without proper risk management strategies in place, traders can expose themselves to unnecessary losses and volatility in the highly volatile crypto market. To mitigate these risks, here are two key strategies that every crypto trader should implement:

Setting Stop-loss Orders

In order to cut potential losses and protect your investments, setting stop-loss orders is an essential risk management technique. A stop-loss order is an instruction placed with a broker to sell a crypto asset when its price reaches a certain specified level. By setting a stop-loss order, you ensure that your losses are limited if the market moves against your position.

https://www.youtube.com/watch?v=_Mp7lPQcKr4

For example, let’s say you buy Bitcoin at $50,000 and set a stop-loss order at $45,000. If the price of Bitcoin drops to $45,000 or lower, your stop-loss order will be triggered and your Bitcoin will be automatically sold, limiting your potential loss to $5,000.

Setting stop-loss orders not only helps protect your investment capital but also allows you to manage your trades effectively without being constantly glued to the market. It is a proactive approach that ensures you have a predefined exit strategy in place.

Determining Position Sizing

Another important risk management strategy is determining position sizing. Position sizing refers to the amount of crypto asset you allocate to each trade based on your risk tolerance and overall portfolio size. By properly determining position sizing, you can control the amount of potential loss on each trade and avoid putting too much capital at risk. This is especially crucial in the highly volatile crypto market where price fluctuations can happen rapidly.

A general rule of thumb is to never invest more than a certain percentage of your total portfolio value in a single trade. The exact percentage may vary depending on your risk tolerance and trading strategy, but it is advisable to keep it below 5% to minimize potential risks. By diversifying your portfolio and allocating appropriate position sizes, you can reduce the impact of any single trade on your overall portfolio.

https://www.youtube.com/watch?v=_Mp7lPQcKr4

In conclusion, risk management is a vital aspect of successful crypto trading. By setting stop-loss orders and determining position sizing, traders can effectively manage their risks and protect their capital. Implementing these strategies can help navigate the volatile crypto market with confidence and improve your chances of success.

5. Day Trading Strategies

Discover 5 day trading strategies that can help you navigate the new trend of crypto trading. These strategies will empower you to make informed decisions and maximize your profits in the ever-changing crypto market.

Day trading in the cryptocurrency market has gained immense popularity in recent years. As traders seek to take advantage of the volatile nature of digital currencies, various day trading strategies have emerged. These strategies allow traders to make quick decisions and capitalize on short-term price movements. In this section, we will explore five popular day trading strategies that can help you navigate the exciting world of crypto trading.

Scalping: Quick Trades For Small Profits

Scalping is a day trading strategy that focuses on making numerous small profits throughout the day. Traders who employ this strategy aim to profit from the bid-ask spread, which is the difference between the buying and selling price of a cryptocurrency. By executing quick trades and taking advantage of small price movements, scalpers can accumulate significant profits over time.

https://www.youtube.com/watch?v=_Mp7lPQcKr4

To implement the scalping strategy effectively, traders rely on technical indicators and real-time market data to identify short-term trends and price fluctuations. Scalpers typically focus on highly liquid cryptocurrencies with high trading volumes, as this allows them to enter and exit positions quickly.

Breakout Trading: Capitalizing On Price Volatility

Breakout trading is a popular strategy among day traders who aim to capitalize on significant price movements. This strategy involves identifying key levels of support and resistance and waiting for a breakout to occur. When a breakout happens, traders enter into positions in the direction of the breakout, hoping to profit from the subsequent price movement.

Traders using breakout trading closely monitor price charts and volume indicators to identify potential breakouts. They use technical analysis tools to confirm the strength of a breakout and determine entry and exit points. Breakout trading requires patience and discipline, as false breakouts can result in losses. However, when executed correctly, this strategy can yield substantial profits.

Both scalping and breakout trading strategies require traders to be alert, decisive, and continuously monitor the market for potential opportunities. It’s essential to set strict risk management rules and adhere to them to protect your capital. Mastering these day trading strategies can give you a competitive edge and increase your chances of success in the crypto trading arena.

https://www.youtube.com/watch?v=_Mp7lPQcKr4

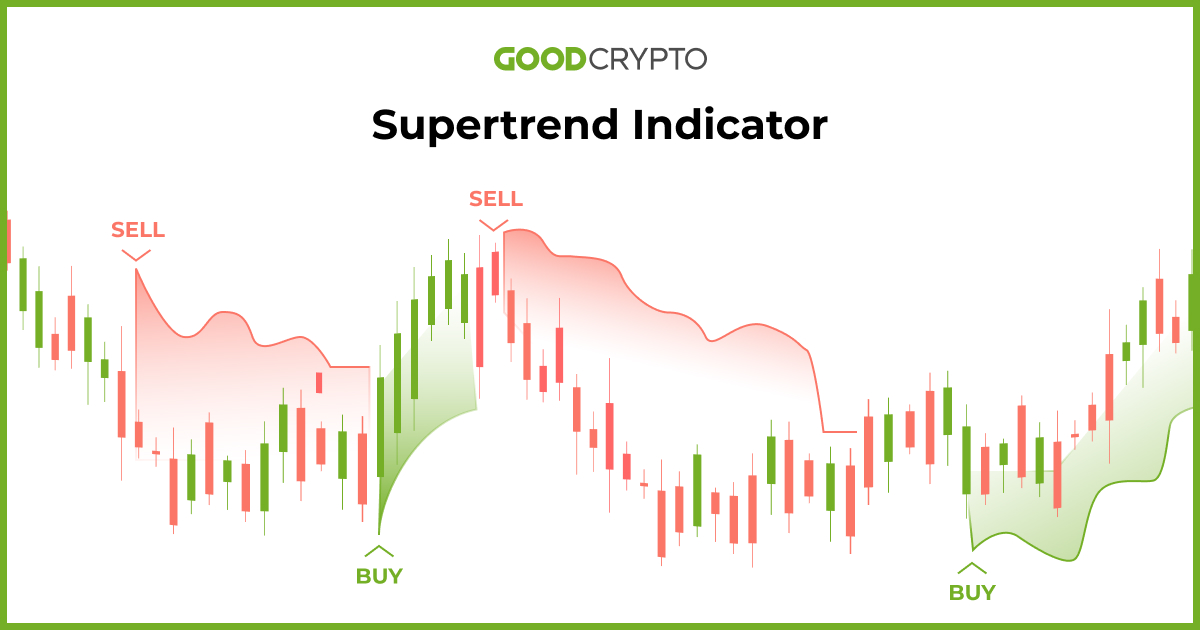

Credit: goodcrypto.app

6. Swing Trading Strategies

Discover the latest trend in crypto trading with swing trading strategies. Learn how to capitalize on market fluctuations and maximize your gains in the fast-paced world of cryptocurrency. Don’t miss out on this exciting opportunity to navigate the crypto market with confidence.

Swing trading is a popular strategy in the world of cryptocurrency trading due to its potential for high returns. In this section, we will explore two effective swing trading strategies: Identifying and riding momentum and Using support and resistance levels. These strategies can help traders make informed decisions and increase their profits. Let’s dive in!

Identifying And Riding Momentum

Identifying and riding momentum is a key strategy in swing trading. By analyzing the market trends and identifying assets with strong momentum, traders can take advantage of price movements and maximize their profits. To implement this strategy effectively, you need to stay updated with the latest news and market trends, as well as use technical analysis tools like moving averages and volume indicators.

https://www.youtube.com/watch?v=_Mp7lPQcKr4

One way to identify momentum is by looking for rapid price movements accompanied by an increase in trading volume. When a cryptocurrency shows a significant surge in price and trading activity, it indicates strong momentum. Traders can enter a trade at this point and ride the upward trend until it shows signs of weakening. It’s important to set stop-loss orders to manage risks effectively.

This helps protect your capital in case the market suddenly reverses. Additionally, continuously monitoring the market and adjusting your strategies accordingly is crucial for successful momentum trading.

Using Support And Resistance Levels

Support and resistance levels are important price levels that act as barriers to price movements. Swing traders can utilize these levels to determine entry and exit points for their trades. Support levels are prices where the demand for a cryptocurrency is strong enough to prevent it from falling further. Resistance levels, on the other hand, are prices where selling pressure is strong enough to prevent the asset from rising higher.

When the price of a cryptocurrency approaches a support level, it may bounce back and continue its upward movement. Traders can take advantage of this by entering a long position with a stop-loss order placed below the support level. Conversely, when the price reaches a resistance level, it may struggle to move higher. At this point, traders can consider short selling or closing their long positions for potential profits. Identifying these levels can be done through technical analysis tools such as trend lines, Fibonacci retracements, or moving averages.

https://www.youtube.com/watch?v=_Mp7lPQcKr4

By combining these tools with other indicators and market analysis, traders can increase their probabilities of making successful swing trades. In conclusion, swing trading strategies like identifying and riding momentum and using support and resistance levels are valuable tools for cryptocurrency traders. These strategies allow traders to take advantage of short-to-medium-term price movements and can be highly profitable when implemented correctly. Remember to stay informed, adapt your strategies to market conditions, and always manage your risks effectively. Happy trading!

7. Long-term Investing Strategies

Crypto trading has evolved into a popular investment option, with enthusiasts continuously exploring numerous strategies to navigate the volatile market successfully. Among the different trading approaches, the long-term investing strategies stand out as a reliable method to capitalize on the crypto potential. It’s crucial to identify promising cryptocurrencies for long-term growth and implement dollar-cost averaging to ensure profitability.

Identifying Promising Cryptocurrencies For Long-term Growth

When choosing cryptocurrencies for long-term investment, it’s essential to focus on projects with strong fundamentals, real-world use cases, and a proven track record of performance. Researching the team behind the project, technology, market traction, and community support can help in spotting promising assets that have the potential for long-term growth.

https://www.youtube.com/watch?v=_Mp7lPQcKr4

Dollar-cost Averaging Approach

Dollar-cost averaging is an investment strategy that involves regularly purchasing a fixed dollar amount of a particular cryptocurrency, regardless of its price. This approach helps mitigate the impact of market volatility and ensures you accumulate more of the asset when prices are low and less when prices are high. Implementing dollar-cost averaging provides a disciplined and risk-averse method to invest in cryptocurrencies over the long term.

Frequently Asked Questions On Crypto Trading : A New Trend

Q: How Does Crypto Trading Work?

A: Crypto trading involves buying and selling digital currencies on online platforms. Traders speculate on price movements to make profits. Transactions are recorded on a decentralized ledger called the blockchain.

Q: What Are The Risks Of Crypto Trading?

A: Crypto trading carries risks such as volatility, security threats, and regulatory uncertainties. Prices can fluctuate rapidly, leading to potential losses. Hackers may target exchanges, and governments may impose regulations that impact the market.

Q: How Do I Get Started With Crypto Trading?

A: To start crypto trading, you’ll need to open an account on a reputable exchange platform. Complete the registration process, deposit funds, and familiarize yourself with the trading interface. It’s important to research and develop a strategy before making your first trade.

Q: Can I Make Money With Crypto Trading?

A: Yes, it’s possible to make money with crypto trading. However, it’s important to understand that trading comes with risks and there are no guarantees. Traders who employ effective strategies, conduct research, and stay updated with market trends have a better chance of making profits.

https://www.youtube.com/watch?v=_Mp7lPQcKr4

Conclusion

To sum up, crypto trading offers potential for individuals seeking to dabble in the exciting world of digital currency. With its high volatility and potential for significant returns, it has become a new trend that investors are exploring. By aligning with the right strategies, understanding market trends, and staying informed, individuals can navigate this new territory successfully.

So, if you’re looking to diversify your investment portfolio and seize opportunities in the crypto market, crypto trading may be the way to go.